It depends on the type of company you’re building.

In places like San Francisco, where you have a lot of high-quality technology investors, they’re looking for really high-growth startups, really revolutionary ideas. They seek extremely intelligent and insightful founders who seem to know something that nobody else does. These investors understand that only a few such founders emerge each year—people who can radically change the world and generate extreme ROI. So, they are always searching for the craziest outliers on every level: outliers in the team, the product, the idea, the traction—something that stands out.

That doesn’t mean everything needs to look like it’s succeeding. A startup could be pre-product, but they are certainly looking for outliers.

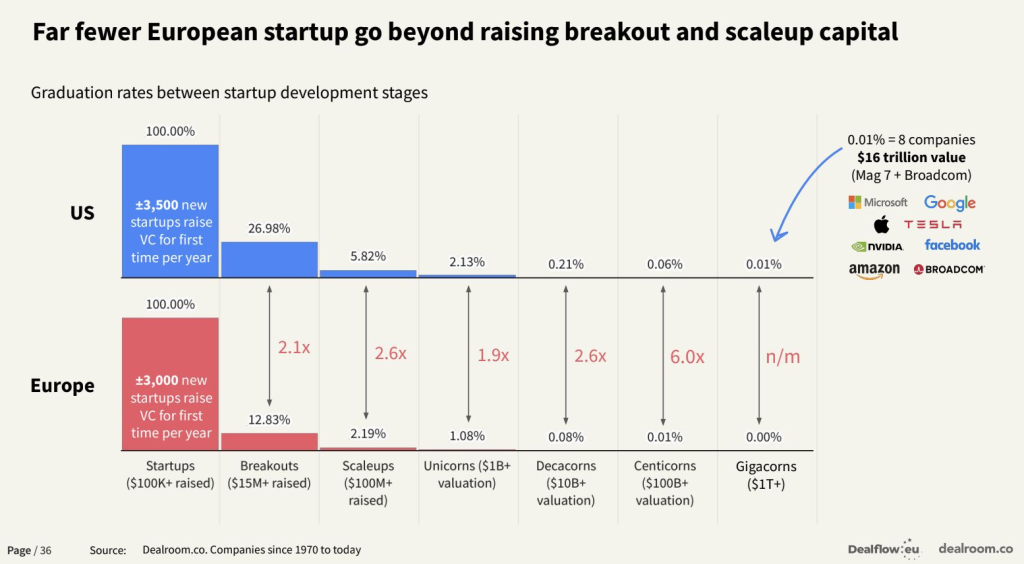

In many other parts of the world, like Europe or Southeast Asia—where the investment culture comes from real estate and other non-tech investments—the risk appetite is much lower. It’s the opposite of building a frontier tech company or being an innovator. In these regions, investors tend to dislike outliers, risk, and unvalidated new ideas.

If you’re building a company in Europe or Southeast Asia, the capital environment will automatically push you to be less ambitious. It rewards you for doing easier things that have been done before—things that have a clear ROI. But those types of businesses usually don’t create the most value for the world, nor do they generate the most money. They can be profitable, but they’re not groundbreaking.

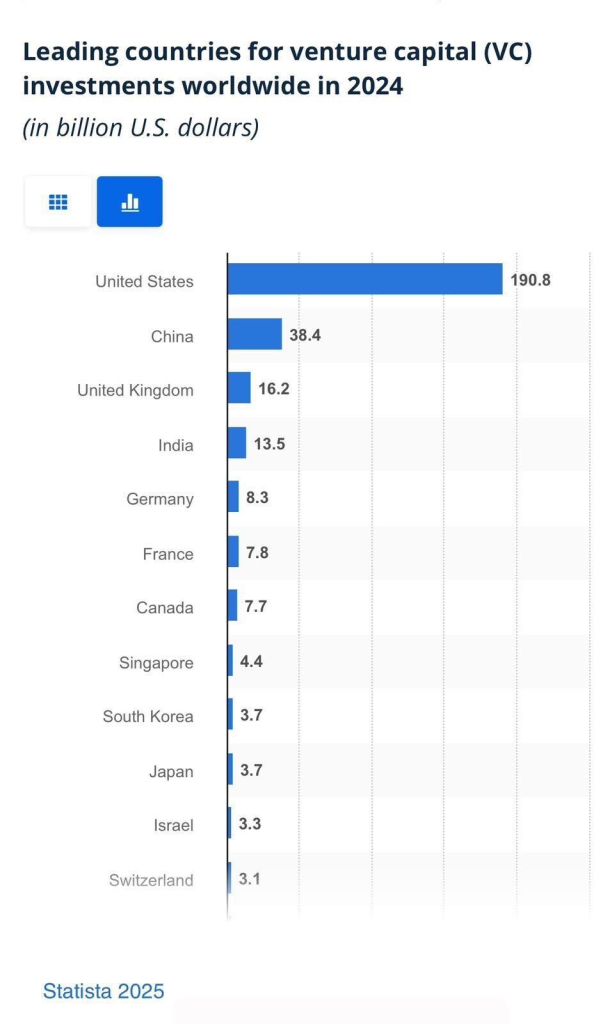

The founders on LearningLoop and I recently shared and discuss these 2 graphs in depth in the private LearningLoop community. These are particularly important to look at, to understand the objective difference in funding environments:

So, it’s important to ask yourself: Why are you building a business, and what sort/amount of capital do you need?

Are you building a business to make $2–3 million or a few hundred thousand dollars in an exit or passive income? If that’s the case, you should probably choose a more traditional, cash-flow-positive business rather than something highly innovative. And for that, there are investors who prefer cash cows—businesses that generate steady returns. They don’t want a 100x return; they’re happy with a 2x return.

On the other hand, if you want to build an extremely innovative company and you’re extremely ambitious—Silicon Valley ambitious—then you should find investors who are looking for that level of ambition.

Investors who seek highly ambitious founders want to see a deep commitment to the problem space. If you say you want to build something in quantum computing, they probably want to see if anyone on your founding team has a PhD in quantum computing. They want to know if there’s a technical CEO who can actually run the company.

If, in the past few years, you’ve spent one year in AI, one year in blockchain, one year in something else, and another year in something else again—nobody will believe that you’re in this for the long run.

Traditional investors want to make sure that you are not a visionary because they tend to be anti-visionary. They might not openly admit they are anti-ambition, but many will admit they are anti-visionary.

If you’re building a lower-risk, lower-reward business, then the investors funding it will be much stricter. They want to see everything upfront. They don’t like to hear, “Oh, I’m figuring things out.” To them, it’s like investing in real estate—they want to know exactly where the land is, what type of property is going to be built, whether it will be a shopping mall or residential. You can’t tell them, “I don’t know yet.”

If you don’t have all the facts upfront, they won’t give you money because they are risk-averse. They want a near-guaranteed 2x return.

Meanwhile, the other type of investor—the high-risk, high-reward kind—invests with the hope of a 1% or 20% chance of getting a 1000x return. They’re looking for founders who embody exponential thinking. They want to see if there’s anything in your life, career, or way of acting that demonstrates you’re capable of a 1000x outcome.

Have you ever done anything in your life that shows you are that extreme in what you wish to accomplish?

Once you have clarity over your positioning, you can tell which investors you should pursue vs avoid.